Positive impact

We care deeply that innovations at the heart of our founders’ businesses have the potential to positively impact people’s lives.

When we review an investment opportunity, we consider its social and environmental impact alongside an assessment of the financial merits of the business. The most attractive companies are those with a sustainable long-term business model with the potential to benefit society.

Read our ESG policyReporting

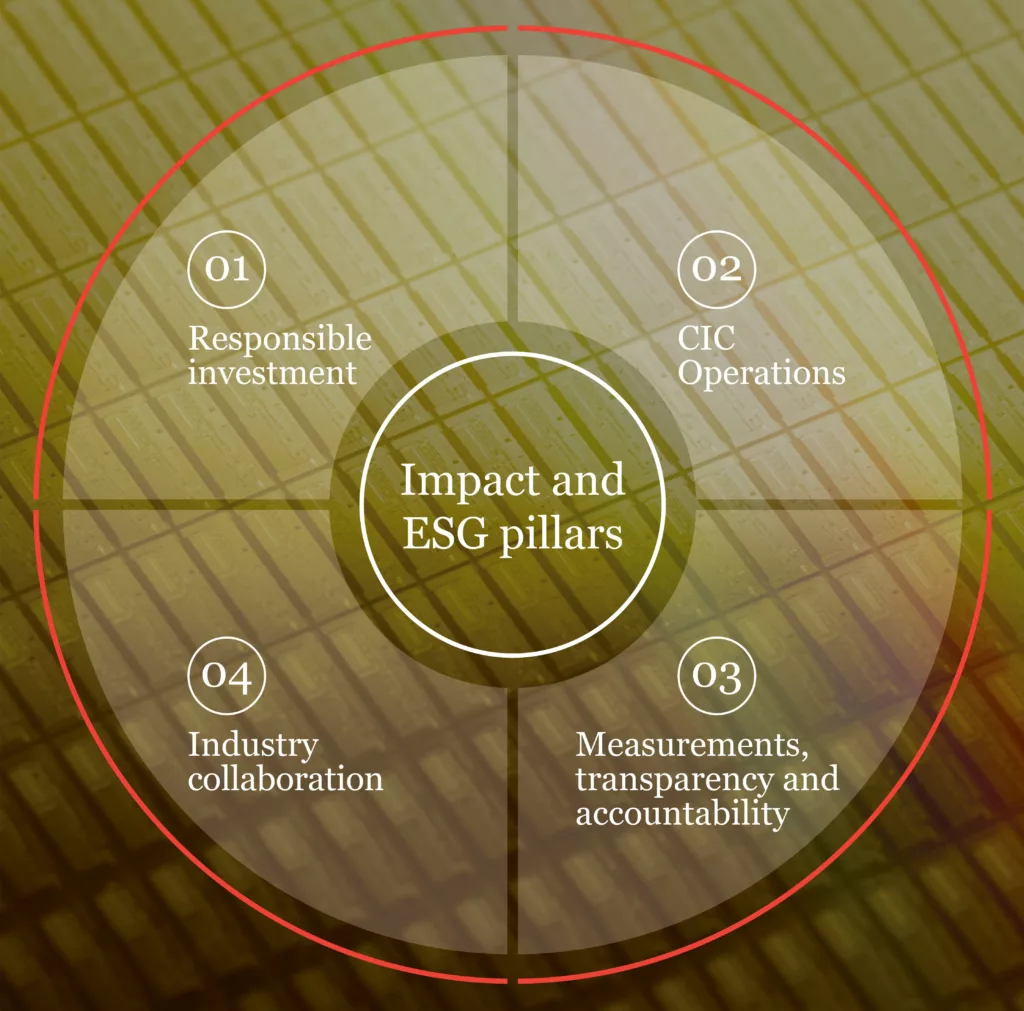

Pillars

Guiding principles

01Responsible investment

We are a signatory of the UN Principles for Responsible Investment, which encourages transparent and evidence-based investment and stewardship. We are also a signatory to the Investing in Women Code, which aims to improve female entrepreneurs' access to tools, resources and finance. Our investment process reviews potential reach and impact of innovations, including numbers of people and likely effect of an innovation on their lives. We consider the environmental impact and low carbon economy benefits and we look at potential employment impacts, including diversity and equality.